As of 1 July 2021, there will be changes to Land Transaction Tax (LTT) in Wales. Up until 30 June 2021, LTT is payable when you purchase or lease a property above the threshold of £250,000. Therefore, currently, no tax is payable on the first £250,000 of a property. LTT is 5% on properties up to £400,000, 7.5% up to £750,000, 10% up to £1,500,000 with any amount thereafter taxed at 12%. However, this is due to change in a few months’ time.

Transactions with an effective date on or after 1 July 2021

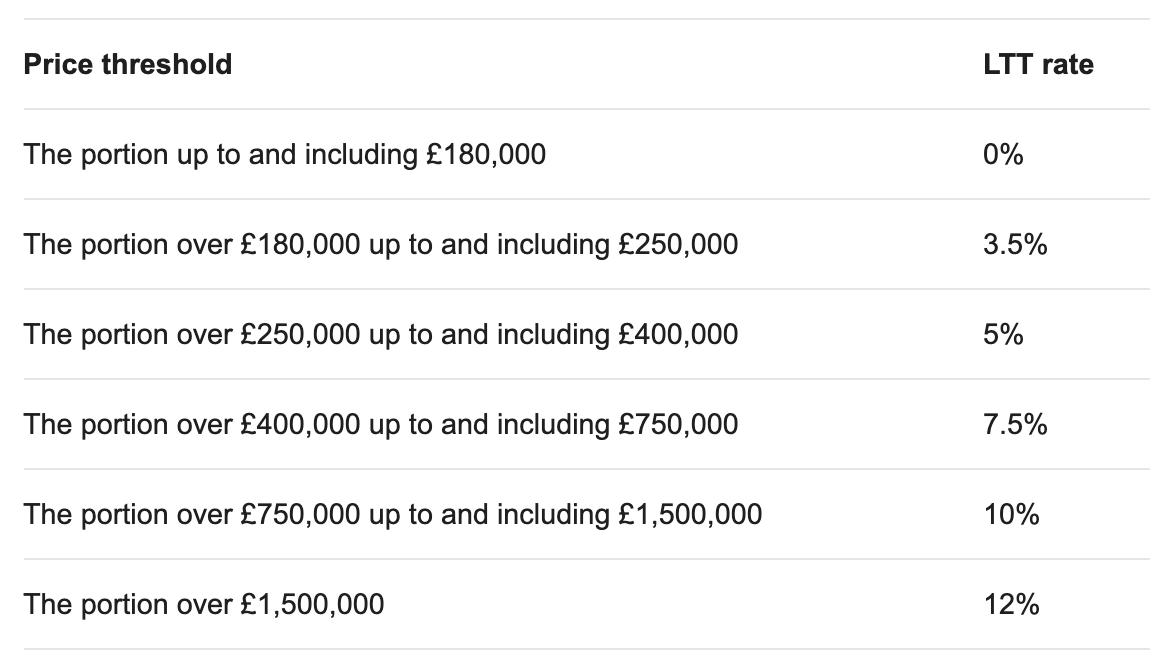

As of 1 July 2021, the LTT paid on a property will revert back to the residential tax rates prior to the temporary changes implemented in July 2020.

When you buy a residential property (freehold or leasehold) you will be required to pay 3.5% LTT on properties between the value of £180,001 and £250,000, 5% on properties between £250,001 and £400,000, 7.5% on properties between £400,001 and £750,000, 10% on those between £750,001 and £1,500,000, with any amount thereafter taxed at 12%. However, if you purchase a property for up to and including £180,000, no LTT is to be paid.

Visit gov.wales for more information