Posted on Tuesday, April 19, 2022

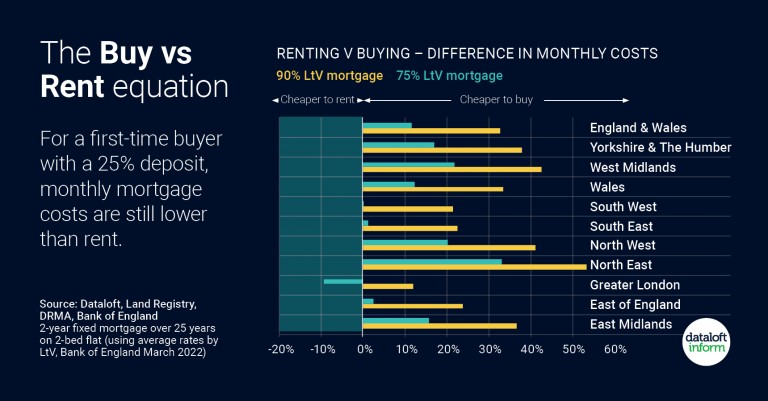

- For a buyer with a 25% deposit, the monthly mortgage payment in all areas remains lower than the equivalent monthly rent for a 2-bed flat (2-year fixed rate mortgage, over 25 years).

- However, for those with a 10% deposit (90% LtV), increased mortgage rates in March mean that in London, the monthly rent would be 9% less than mortgage payments, and there is virtually no difference in the South West, South East and East.

- For first-time buyers, getting together a deposit is still the most significant barrier to home ownership. Maintenance costs and giving up flexibility are other considerations.

- As interest rates continue to rise, the monthly cost gap is likely to narrow further in all regions and this may see more 'would-be' first-time buyers evaluating their housing options. Source: Dataloft, Land Registry, DRMA, Bank of England