Prime London prices continue to hit record levels but actual sales vary depending on values.

Figures from property data company LonRes for May show prices across the capital’s prime market rose 5.8% during the past 12 months and are now 0.2% higher than the pre-pandemic average for 2017-19.

New instructions are also up 2.9% compared with 2017-2019 levels while there has been a spike in the number of properties put under offer in recent weeks, LonRes said.

However, the number of sales was 29.1% lower in May 2022 than the same month last year.

There are some differences depending on the price band though.

Sales of homes priced above £2m in the first five months of 2022 were only slightly lower than the same period last year, LonRes said.

Meanwhile, the number of sales for lower-priced homes under £2m has fallen compared to last year – though they are still well above the levels seen immediately prior to the pandemic.

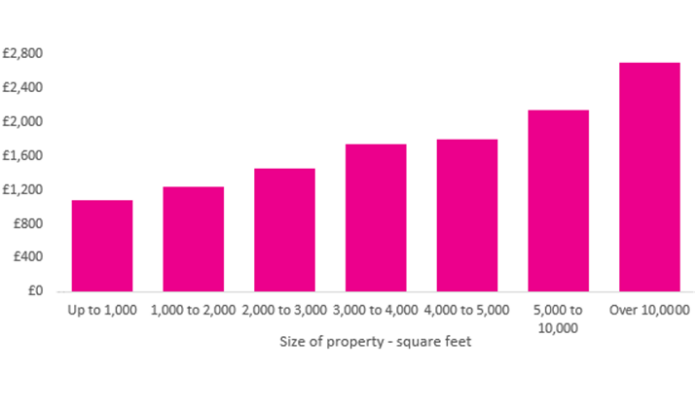

LonRes has also crunched numbers on the premium prime buyers are paying for extra square footage.

Around 1-1.5% of transactions in prime London every year are homes sized between 5,000 and 10,000 square feet while a handful are over 10,000 square feet.

This compares with the average-sized home in England, according to the 2020 English Housing Survey, of just 1,029 square feet.

Given the rarity of these palatial homes, they also tend to sell for a premium compared to other smaller homes, LonRes said.

For example, the average price per square foot for a home between 1,000 to 2,000 sq. ft is £1,200.

That rises to £2,000 for 5,000 to 10,000 sq. ft and £2,800 for Buckingham Palace-style mega-mansions of more than 10,000 sq.ft.