A growing number of homebuyers are successfully negotiating more substantial discounts on property purchases in anticipation of the stamp duty increase scheduled for April 2025, according to Hamptons, part of the Connells Group.

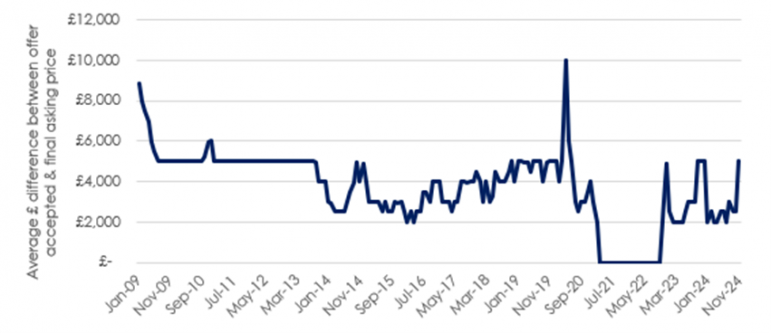

The estate agency reports that the average buyer who had an offer accepted in November 2024 negotiated a median discount of £5,000 off the asking price. This is the biggest discount since December 2023 and has doubled from £2,500 in October 2024.

Average (median) discount secured on a property purchase

Source: Hamptons

In England & Wales, more than half – 55% – of buyers successfully negotiated a discount of £2,500 or more last month, up from 51% in October 2024. However, discounts remain less common than last year when mortgage rates peaked. In December 2023, 58% of homes were sold for at least £2,500 less than their asking price, which was the highest proportion since May 2020 during the Covid lockdown.

Despite the increase in discounts, the average seller in England & Wales still secured an average of 98.2% of their final asking price last month. Whilst this figure has fallen slightly from 98.8% in October, it remains higher than the same month last year (98.0%) and up from 97.9% in November 2019, which reflects a typical low interest rate, pre-Covid market.

Completion times

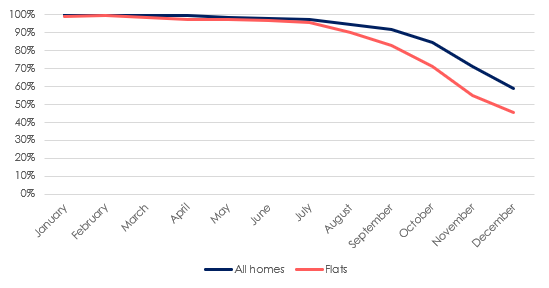

Share of sales agreed each month that complete by April in the following year

Source: Hamptons

Buyers are running out of time for sales to complete before stamp duty bills increase in April 2025. Historic data suggests that around 71% of all sales agreed last month should complete before April next year. However, only just over half of flat purchasers (55%) are likely to complete in advance of the stamp duty deadline. The average flat sale takes 39 days longer to reach completion than a house, a differential which has steadily grown over the last five years.

Historically, just 37% of purchases agreed in January would go on to complete by April of the same year. These tend to be cash purchases where the buyer is in a position to proceed quickly.

First-time buyers

Share of first-time buyers achieving a discount of £2,500 or more

| Nov-23 | Oct-24 | Nov-24 | |

| London | 51% | 44% | 50% |

| South | 55% | 46% | 49% |

| Midlands | 56% | 38% | 46% |

| North | 41% | 38% | 45% |

| England & Wales | 51% | 44% | 48% |

Source: Hamptons

First-time buyers, some of whom will face larger increases to their stamp duty bills in April, have also successfully negotiated bigger discounts. The threshold at which first-time buyers start to pay stamp duty is set to fall from £425,000 to £300,000, meaning the share of people buying their first home who will be subject to a bill will more than triple from 8% to 26%.

The average first-time buyer in England & Wales achieved a 1.3% or £2,000 discount off the asking price last month. While 51% of first-time buyers had a below asking price offer accepted, 48% managed to negotiate a discount of £2,500 or more in November. This latter figure has risen from 44% in October and a recent low of 41% in July.

In London, where first-time buyers are more likely to face the full £11,250 stamp duty increase from April, half (50%) of first-time buyers had an offer accepted at least £2,500 below the asking price, up from 44% in October. Meanwhile, those buying their first home in the North of England, where property prices are lower on average, are less likely to see their stamp duty bill rise due to the nil-rate threshold of £300,000. Here, just 45% of first-time buyers negotiated a discount of £2,500 or more.

The stamp duty increases next year are hitting the purchasing power of those buying homes below £1m hardest. The proportion of the asking price achieved for homes sold between £500k-£1m fell by 0.7% between October and November to an average of 98.1%. Meanwhile, homes sold for less than £500k saw a 0.6% month-on-month decrease to an average of 98.3%. Here, the maximum £2,500 increase in a mover’s stamp duty bill in April makes up a bigger share of the overall property price.

Offer accepted price as a proportion of the final asking price (England & Wales)

Source: Hamptons

Meanwhile, those purchasing £1m+ homes have been less sensitive to impending stamp duty hikes. The average vendor who agreed to sell a £1m+ home last month achieved 96.9% of their asking price, a figure that has been gradually recovering since the election in July.

Aneisha Beveridge, head of research at Hamptons, said: “A month on from the Budget, we’re starting to see how changes are playing out in the housing market. The number of sales being agreed is ending the year strongly as buyers look to secure a home ahead of the stamp duty rise next year. But the window to lock in a pre-April 2025 completion is closing quickly.

“The chance of a sale agreed in December reaching completion before next April is now close to a coin flip. Sales that are part of long chains or where management companies are slow to respond to enquiries are now likely to incur higher stamp duty bills. Historically, only 37% of purchases agreed in January go on to complete by April of the same year.

“Buyers are beginning to factor in the cost of higher stamp duty bills and recent small increases in mortgage rates by pushing for bigger discounts. And often, sellers, who are keen to agree a deal before Christmas, are accepting. However, those purchasing more expensive homes have been less sensitive to the change. The £2,500 stamp duty increase is a smaller chunk of their overall purchase price. Furthermore, the Budget provided a bit more clarity about the future, supporting pricing at the top of the market.”