Posted on Thursday, January 30, 2025

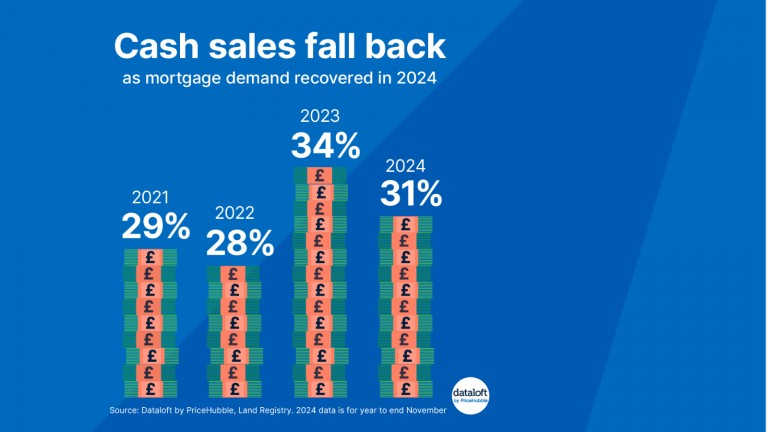

- In 2023, there was a particularly strong presence of cash buyers (not requiring a mortgage): 34% of sales England and Wales were for cash, compared to 28%, the average for the 5 years prior to that. This trend has largely reversed in 2024, as mortgage rates started to come down and affordability started to improve, mortgages accounted for a higher proportion of sales (cash sales slipped to 31%).

- This is another signal that the market was back to a more usual status quo in 2024, certainly for the second half. Expectations for 2025, with further interest rate falls expected and improvements in affordability as a result, then mortgages should continue to account for an increased proportion of sales.

- A greater range of active buyers, should help drive the modest uplift in prices that is anticipated this year. Source: Dataloft by PriceHubble, Land Registry HPI