Research by Lomond, one of the UK’s largest estate and letting agency groups, has revealed the top 10 postcodes that are currently offering the strongest rental yields to buy-to-let investors, as well as those that have seen yields increase by the largest margin on an annual basis.

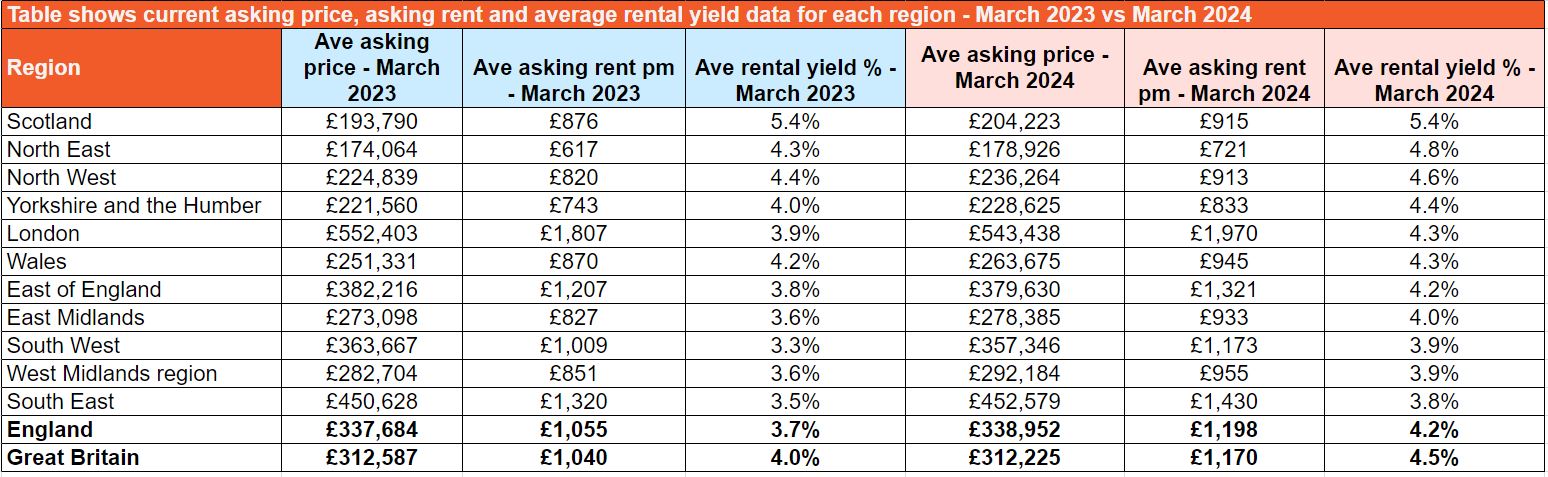

The figures show that across Britain as a whole, the average rental yield currently stands at 4.5%, having increased from 4% this time last year.

Strongest regional rental yields

At 5.4%, Scotland is home to the strongest average rental yield at a regional level, with the North East (4.8%) and North West (4.6%) also ranking within the top three.

In contrast, the lowest average rental yield is currently found in the South East at 3.8%.When broken down to postcode level, the research by Lomond shows that there are far stronger yields available in the current market.

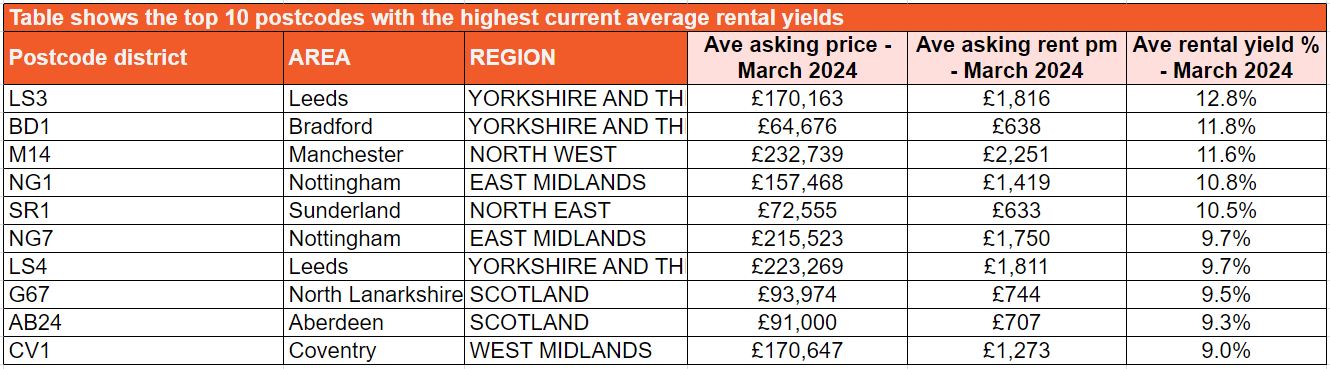

Best performing postcode pockets

The LS3 postcode of Leeds ranks as the strongest pocket of the British rental market at present, with the average yield sitting at an impressive 12.8%.

In fact, it’s a Yorkshire one-two, with Bradford’s BD1 postcode having an average yield of 11.8%, while the Leeds postcode of LS4 comes in as the seventh best in the country with an average yield of 9.7%.

Manchester’s M14 postcode is home to the third best rental yield in the nation at 11.6%, followed by Nottingham’s NG1 postcode (10.8%), while the city’s NG7 postcode sits at number six (9.7%).

Other areas to make the top 10 include Sunderland’s SR1 postcode (10.5%), the Scottish postcodes of G67 (9.5%) and AB24 (9.3%), as well as the Coventry postcode of CV1 (9%) which flies the flag for the West Midlands.

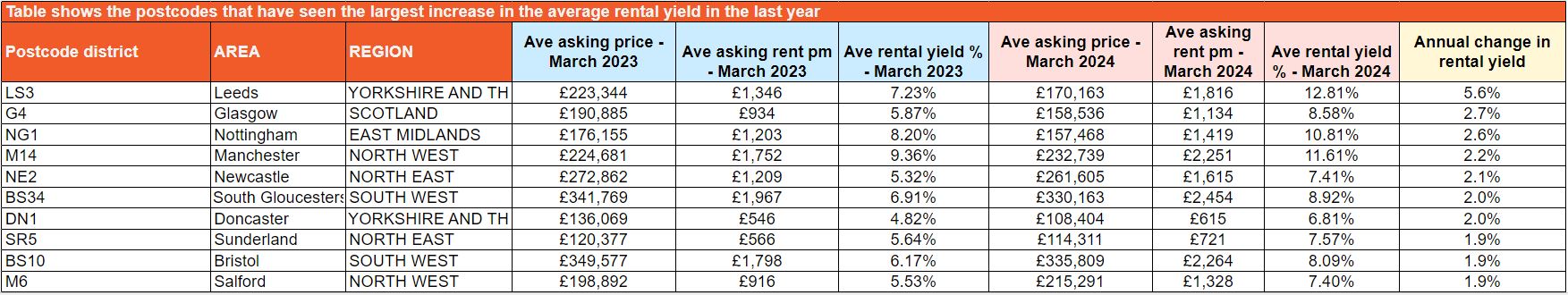

Largest increase in the average yield

The Leeds postcode of LS3 not only tops the table as the strongest yield in the current market, but it has also seen the largest annual increase, up 5.6% in the last year alone.

Glasgow’s G4 postcode has seen the second largest increase in the average rental yield at 2.7%, with Nottingham’s NG1 postcode completing the top three having increased by 2.6% annually.

CEO of Lomond’s Yorkshire brands, Martin Elliot, commented:

“Despite the government’s best efforts, buy-to-let investment remains a lucrative endeavour and we’ve seen the average yield on offer increase across all regions of Britain over the last year, with the exception of Scotland where it has remained static.

So while the government may have attempted to lure more landlords away from the rental sector with a cut in capital gains tax, it remains a very good time to invest in rental market bricks and mortar.”

Asking price, asking rent and average rental yield data sourced from PropertyData (March 2024 vs March 2023).